Financial Action Learning System (FALS) Toolkit produced 2017-2018 as part of the Bridging the Gender Gap project implemented by Oikocredit, ASKI and NWTF in Philippines and funded by Church of Sweden.

FALS Phase 1

Catalyst Tools

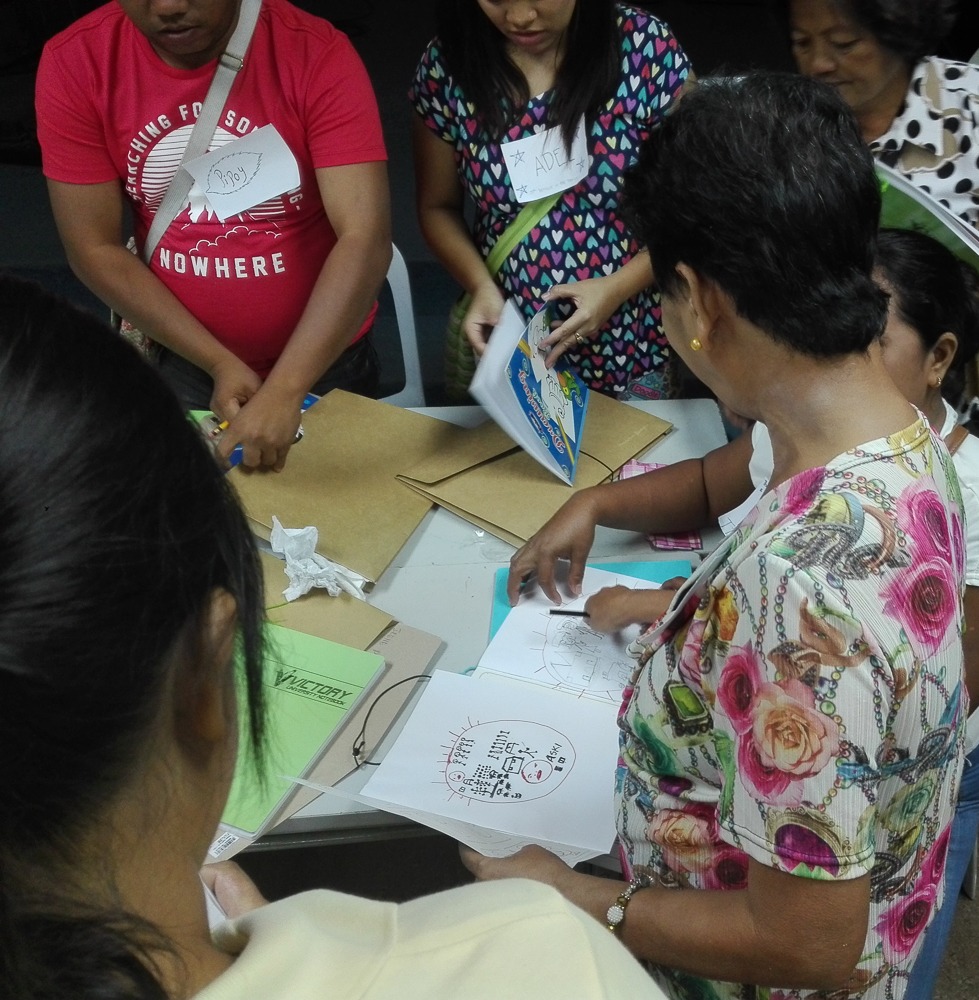

Five tools are introduced over 2 weeks with clients and staff being trained in parallel to allow both clients and staff to learn the same tools and use them for their own personal lives, and for staff to learn clients and for both to learn facilitation skills. Details of the programme are adapted to the schedules of clients and staff with a combination of half and full days.

The tools are facilitated in different ways depending on particular mixes of participants, aiming for each set of participants to have a coherent and cumulative skill set and able to share with others in different types of setting.

For guidelines and examples of different facilitation options and techniques for FALS see:

Empowering Facilitation Techniques

Suggestions for participatory facilitation of workshops for the catalyst tools based on experience in the Philippines are given for each tool below. Peer sharing is mostly done informally based on the mobile versions and animations of the tools.

Gender Empowerment Tools

Tool 1: Vision Journey (VJ)

The Vision Journey introduces basic drawing, diagramming, participatory and planning skills: What does a happy family look like? what are women, men and children doing? what do they have? who owns what? what is the role of micro-finance? What is there already? what important changes are needed? What are my opportunities and challenges to reach my vision? What is my target by the end of the loan cycle, and what are the steps to achieve it?

FALS Tool 1 Vision Journey mobile version

FALS Tool 1 Vision Journey screen presentation

FALS Tool 1 Participatory Workshop Facilitation Notes

Tool 2: Happy Family Tree (HFT)

The Happy Family Tree looks in more detail at division of work, expenditure, assets and decision-making in the family. How to make these both more efficient and equitable. This tool forms the basis of empowerment and gender indicators for SPM, and a tool that can be used and aggregated to assess change.

FALS Tool 2 Happy Family Tree mobile version

FALS Tool 2 Happy Family Tree presentation

FALS Tool 2 Happy Family Tree: Participatory Workshop Facilitation Notes

Financial Empowerment Tools

Tool 3: Financial Empowerment Map (FEM)

The Financial Empowerment Map looks at emotional, financial and power relationships that can help or constrain progress, including access to financial resources and people they can share the empowerment tools with. As well as increasing understanding of clients’ lives by FSP staff, this tool forms the basis for the upscaling plan and identification of champions who might be paid in future.

FALS Tool 3 Financial Empowerment Map mobile version

FALS Tool 3 Financial Empowerment Map Presentation

FALS Tool 3 Financial Empowerment Map: Participatory Workshop Facilitation Notes

Tool 4: Loan Business Challenge Action Tree (LBCAT)

The Loan Business Challenge Action Tree identifies in more detail recurrent challenges for the business for which they propose to take the loan in relation to production, marketing and household, looking at gender issues and role of micro-finance. This Tool is also used by the FSP for participatory market research on specific products and services.

FALS Tool 4 Business Challenge Action Tree mobile

FALS Tool 4 Business Challenge Action Tree presentation

FALS Tool 4 Business Challenge Action Tree : Participatory Workshop Facilitation Notes

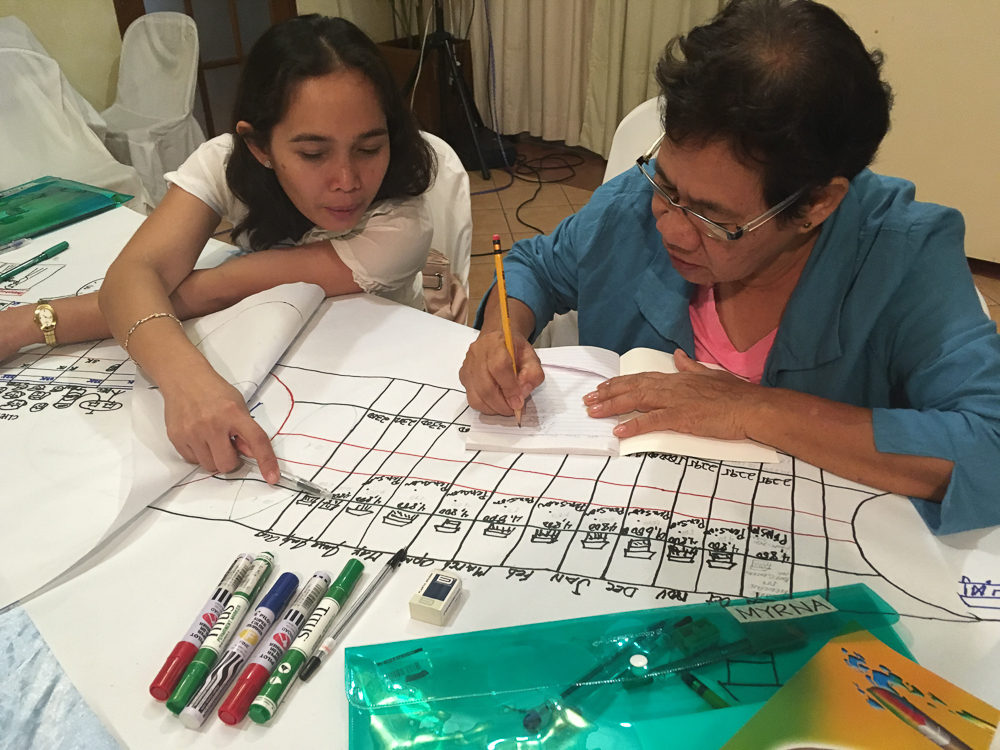

Tool 5: Financial Management Calendar (FMC)

The Financial Management Calendar is a plan for business and financial management, integrating learnings from the Happy Family Tree, Financial Empowerment Map and Challenge Action Tree. The tools is tracked as a tool for learning to manage businesses and finance better. At FSP level this becomes over time a required part of the loan application process, and assessing applications for loan rescheduling. When applying for loans clients need to bring any previous FMCs and a new FMC for the loan being applied for.

FALS Tool 5 Financial Management Calendar mobile version

FALS Tool 5 Financial Management Calendar presentation

FALS Tool 5 Financial Management Calendar : Participatory Workshop Facilitation Notes

FALS Review:

Client Empowerment Deepening

In March 2018 a further 5 day workshop was held to review the changes and tools so far, and bring them together to deepen client empowerment, particularly on gender issues.

Tool 6: Gender Empowerment Diamond (GED)

The Gender Empowerment Diamond looks at gender issues that constrain women and men from achieving their full potential. This builds on the discussion from Tool 2 Happy Family Tree and serves as a retrospective review of the changes that have happened because of FALS. It also identifies client priorities for further changes. These then enable client-led identification of gender indicators that can be integrated into SPM and used as a gender checklist for assessing product innovation. This same tool can be used with staff as part of development of an organisational internal gender policy.

Tool 7: Empowerment Vision Highway

The Empowerment Vision Highway brings together the Loan Management Calendar, Happy Family Tree/Client Empowerment Diamond and Financial Resources/Change Leadership Maps into a 3 lane ‘Highway’ plan. This is used to summarise the economic, gender and leadership changes that have happened because of FALS, and plan further change on all three lanes for the next loan cycle.

FALS Phase 3:

Sustainable Mainstreaming

FALS is a two year process and goes therefore beyond the one year pilot project. Sustainable mainstreaming entails FALS integration into:

- Loan Management: Full integration of the Loan Management Calendar, backed up by the other tools in case of repayment difficulties into the loan application process implemented by loan managers. This has started with the pilot, but requires a couple of loan cycles to fully refine and train all project management staff and the clients.

- Other capacity building, and possibly addition of other PALS/value chain/GALSatScale tools. This has started – for example use of the Vision Journey for staff career planning. But needs further training of the MFI in other PALS tools. Integration serves to reduce costs of FALS training and means that other trainings are further strengthening client planning, participatory, communication and analytical skills.

- SPM as client empowerment and gender indicators with manageable modes for collection of information by loan management and/or SPM and/or other research staff.

- Product innovation and market research process: this requires capacity building, piloting and refinement of a further Tool 8: Win-win product innovation tree (based on other PALS Challenge Action/Win-win trees in value chain development).

Suggestions on how each tool can feed into the above is given in the guidelines for each tool above. How FALS can be streamlined and integrated into activities of each of the participating partners is still to be further developed and piloted together with clients based on experience by September 2018.

Impact Assessment

French C Vibar 2019 Bridging the Gender Gap in Responsible Finance (FALS Impact Evaluation Report, Business Fair Trade Consulting, Quezon City, Philippines March 2019

This internal impact evaluation followed up on 16 out of the total 42 clients were interviewed at a one day participatory session using the Most Significant Changes methodology. It is unclear how this sample was selected. This information was supplemented through interviews with NWTF and ASKI staff .

Two most significant change [MSC] stories were selected from among the experiences shared by champions.

When good news spreads – the Josephine Osorio story presents an inspiring story of how a church and community leader integrated FALS in her membership promotion. She was able expand loan size of her association from €2,100 [ ₱125,000] for 25 members to €125,000 [₱7.4M] for 600 members.

From transaction to transformation – the Irene Pajarillo-Valdez story features the story of a client caught in a vicious cycle of loans and repayments. Through FALS, she expressed her dream/vision of a family home and a business providing stable income. She shared how using the tools has opened doors for negotiating gender roles in the family and guiding her towards the realization of her family vision.

Learnings from the pilot were classified at three levels (p8):

At champions’ level

1.1. Most clients are interested in more than just taking loans. They also want to be able to save, identify a stable source of income, and plan for a secure future -for themselves and their family. FALS tools and methodology appealed to the champions because they address their felt needs.

1.2. The informal peer support system among champions helped sustain interest in implementing life plans and in promoting FALS.

1.3. Although champions may have achieved their goals/visions and improved quality of life by using FALS tools as guides for life and business planning, they need additional support to address emerging needs. For instance, some champions asked about modalities of a retirement fund. Another champion still borrowed money from a loan shark to buy household appliances. A fisherfolk leader identified the need for a solar drier for drying fish.

At MFI level

1.1. MFI’s can play an important role in addressing social norms that constrain women’s financial inclusion.

1.2. The value of FALS tools depend on the quality of information generated through it. ASKI and NWTF can help clients produce relevant information by facilitating completion and updating of tools.

1.3. Current capacity of MFI staff is not enough for them to effectively facilitate FALS implementation and optimize its benefits.

1.4. The value of FALS as an approach to gender mainstreaming in ASKI and NWTF has been demonstrated by the pilot; the business case is yet to be established.

At project/partnership level

- 1.1. Engaging ASKI and NWTF is a strategic move in testing the viability of FALS to mainstream gender in microfinance. Both institutions cater to marginalized sectors, mostly women who could use some leverage to achieve financial inclusion.

- 1.2. Just as the clients are provided with capacity building support to use the FALS tools, MFI staff also need to be equipped with FALS facilitation skills and knowledge. Product development and innovation capabilities of staff need to be enhanced, too.

- 1.3. The regular movement of staff to different assignments may slow the implementation of FALS as new relationships and trust need to be built anew. It should be included as part of roll out consideration.

- 1.4. A monitoring mechanism or system is needed to track changes attributable to FALS. Baseline data on the clients is an important component for monitoring.