FALS works with micro-finance and financial service providers to promote financial inclusion and empowerment as integral to sustainable ‘Responsible Finance’.

What Is Financial Action Learning For Sustainability?

!!! to be done

‘Financial Action Learning for Sustainability’ (FALS)

promotes:

an inclusive, empowering and financially sustainable partnership

between

- women and men from all backgrounds, including the ultra-poor and marginalised groups

- Financial Service Providers.

through integrating:

- client financial empowerment through sharing of pictorial financial planning and management methodology

- strengthening of community financial organisations and social networks

- FSP-level product market research and social performance management

FALS adapts simple proven pictorial diagram tools from the generic Participatory Action Learning System (PALS) empowerment methodology for:

- Client financial empowerment to enable women, youth and men from all social and economic backgrounds, including the poorest and those without formal education, to effectively identify and plan how they can best use and benefit from financial products.

- Building inclusive local financial networks: FALS Tools enable women and men to share and upscale good financial management and planning practices with other clients and potential clients, ultimately building a sustainable network of community financial advisers.

For Financial Service Providers – Community-based Financial Organisations (CBFOs), Micro-finance Institutions (MFIs) and formal sector service providers:

- Greater sustainability: funding member/client financial management skills and peer-sharing networks becomes an integral part of business expansion to bring in new reliable clients, reducing costs of following up bad debts and product marketing.

- Participatory product design and market research based on use of FALS planning and analysis tools with groups of members/clients from different backgrounds to discuss potential improvements to products that could increase their usefulness to clients and also be profitable for FSPs.

The basis for this inclusive, empowering and financially sustainable partnership is the development and implementation of:

- Responsible Finance Memorandum of Understanding (RFMOU) between clients and FSPs, developed by all members/clients and integrated into application processes for loans and other services. This is the core FALS tool in the form of a pictorial Financial Management Calendar based on mutually agreed Member/Client Protection Principles and the understanding that sustainable client empowerment also requires sustainability of the FSP (whether commercial or member-owned) to continue to develop and deliver quality products and services.

All these member/client-led inputs form the basis for a parallel process at all stages of:

- Organisational Visioning, Planning and Capacity Building using the same tools within organisations and integrated into staff training enable clearer organisational understanding of responsible finance strategies based on the realities of clients, including women and youth. This leads to better decision-making and communication at all levels.

FALS Evolution and Resources

FALS originated in use of PALS tools as part of participatory gender mainstreaming with MFIs in India (sponsored by ANANDI and CERMI), Bangladesh (CAFOD), Nepal (PACT) and Pakistan (Aga Khan Foundation) 2000-2006, followed by work with MFIs in the Latin America Micro-finance Networks in Central (Nicaragua, Guatemala, Honduras and Costa Rica) and South America (Peru, Ecuador, Colombia, Bolivia) for SNV, Hivos and Oxfam Novib and Sudan with LEAP-PASED. It also build on work in Uganda with the Microfinance Associations of Kabarole Research Centre, Trickle-Up US and savings and credit members of Bukonzo Joint Cooperative Union.

Under Oxfam Novib’s WEMAN programme in 2007 a preliminary draft concept note was developed for FALS as a Financial Action Learning System, and further developed for IFAD’s Rural Finance Programme (RUFIN) in Nigeria.

For discussions and materials on women’s empowerment and gender mainstreaming in microfinance see:

Mayoux, L. C. and M. Hartl (2009). Gender and rural microfinance: Reaching and empowering women: Guide for Practitioners. Rome, IFAD.

Mayoux, L C (2011) Women are Useful to Microfinance: How Can We Make Microfinance More Useful to Women? Presentation to Micro-Credit Summit Campaign Conference

Gender Justice Protocol for Microfinance, signed by participants at MicroCredit Summit, Bali 2011

Financial Action Learning System

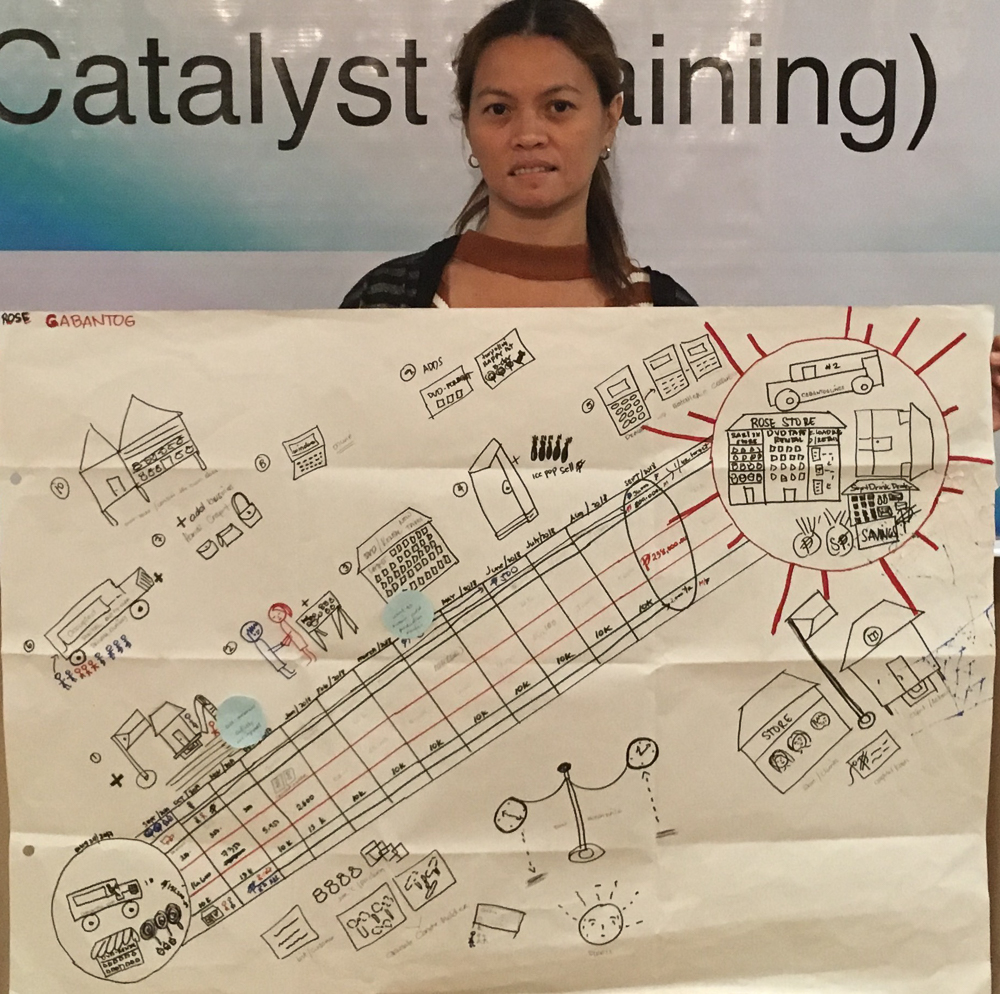

FALS was fully piloted for MFIs in Philippines with Oikocredit, NWTF and ASKI and funded by Church of Sweden. It started to be developed for use in VSLAs in Nigeria as a follow-on from GALS under the IFAD/Oxfam/Hivos Empower@Scale project in 2022.

FALS@Scale

Financial Action Learning for Sustainability at Scale (FALS@Scale) is:

A participatory visual methodology for financial inclusion and empowerment of women and men, including the ultra-poor, to:

- enable women and men from all backgrounds, particularly those from marginalised and financially disadvantaged households, to better access, manage and benefit from financial resources as the basis for

- sustainable and empowering community-based financial organisations (CBFOs) and

- an accessible and socially responsible formal financial sector.

FALS@Scale is intended primarily as an entry point inclusive pictorial financial planning methodology to establish visual communication and participatory leadership skills and upscaling systems for more advanced inclusive livelihood development processes.

Why FALS@Scale?

Although establishment of CBFOs has increased access to savings and credit for very large numbers of previously financially excluded populations, studies (including FARMSE reports) have often shown that:

- even where women are the majority of the membership, leadership is often by men or by better-off women. This affects the degree to which women benefit from decisions made by CBFOs.

- women provide the majority of the savings – sometimes foregoing food – but receive the minority of loans

- the contribution to increasing incomes is often marginal – even where loans are invested in production, women’s incomes are generally used for the household while men then keep more of the money that they previously contributed for themselves

- although CBFOs may strengthen social networks, they may also disrupt networks when problems arrive. They also often exclude the poorest and most disadvantaged.

- linkages between CBFOs and the formal financial sector remain weak, particularly for women and more disadvantaged clients.

At the same time many contexts where development agencies are trying to implement inclusive and empowering financial service projects face challenges that require a more simplified entry point:

- low levels of literacy and/or multiple local languages require a pictorial approach where visual communication skills need to be developed at all levels.

- large distances between communities making frequent face-to-face meetings costly in time and energy as well as budget making on-line delivery through the expanding mobile phone networks a better option for part (not all) of the capacity-building.

- difficulties attracting men to join ‘women’s empowerment’ processes, thereby seriously limiting what women as well as men can do to promote gender justice and hence also effectiveness of livelihood interventions.